One of my favourite investing books is Joel Greenblatt’s You Can Be a Stock Market Genius. Despite the cheesy title, the book has many great insights applicable to all types of investing. One key concept from the book is “forced sellers“. Greenblatt articulates how large institutional funds occasionally become forced sellers of assets because of their arbitrary investing rules combined with various corporate actions taken by their portfolio companies.

For example, many institutional funds can’t own businesses below a certain size. Let’s say a company divests a small, but highly profitable, division to shareholders that doesn’t meet many institutional funds’s company size mandate. This causes indiscriminate selling regardless of the quality of the asset.

This creates an opportunity for smaller investors, who don’t have a strict size mandate. As a result, they’re able to pick up a quality asset for a discount because of the forced selling.

Forced Buyers

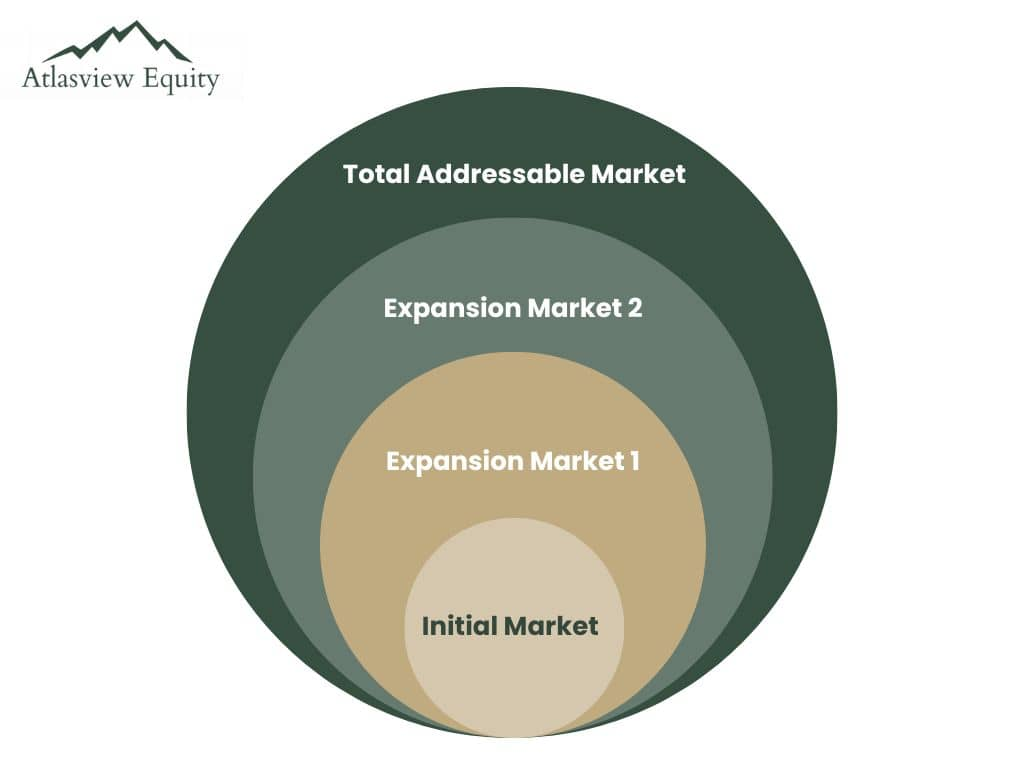

Let’s invert this concept of forced sellers into forced buyers. Private equity firms, especially larger/institutional ones, all invest based on mandated criteria. If you study these firms, you’ll notice many of them have nearly identical investment criteria. Targets have to check a bunch of boxes for the PE firms to invest.

These PE firms have raised time-sensitive capital that’s mandated to be deployed into businesses that tick the boxes. As a result, businesses that tick all the boxes trade for premium multiples – because they are pursued by several forced buyers.

However, businesses that don’t tick all the boxes can be picked up for a discount. This creates an opportunity for smaller buyers, such as Atlasview, to purchase otherwise high-quality businesses that may be missing 1 or 2 of the common PE criteria. It’s an especially compelling investment for us if we can make changes to the business to address the criteria gaps in a reasonable timeframe.

The whole concept of forced buyers/sellers requires some knowledge of how institutional counterparties invest. Institutional investors control a lot of capital and can significantly influence asset prices, so it’s worth spending time studying their mandates. This knowledge will help answer the critical question of “Why am I able to purchase it for an attractive multiple?“, a topic which I’ve covered in a previous post called Business Returns vs Investment Returns.

Gems

Sharing some interesting gems I stumbled upon…

- RCP Advisors published a nice research piece called The Case For Small Buyouts. The link takes you to part 1 of a 3-part series discussing the structural advantages of investing in the lower middle market. I’ll share parts 2 and 3 as they publish them.

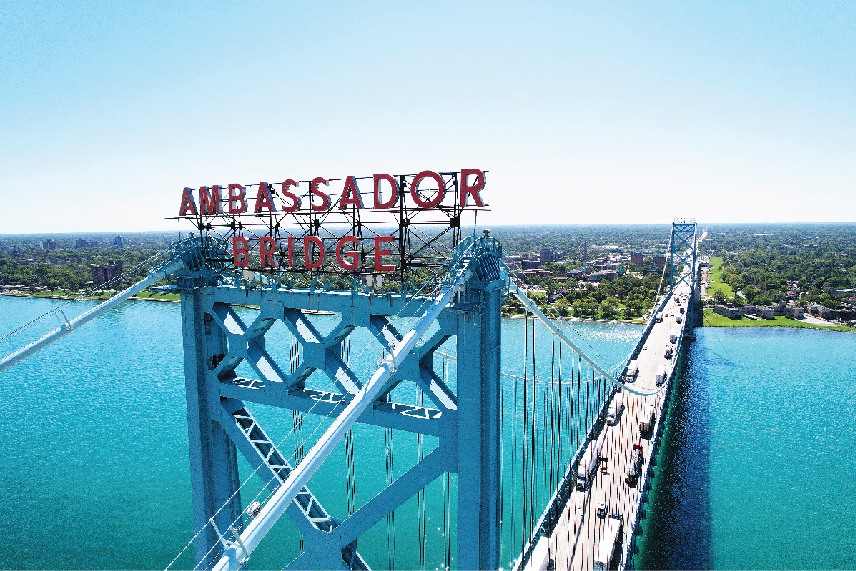

- Video on the 407 ETR – a while ago I shared a gem about the Detroit International Bridge Company and compared it to the 407 ETR in Canada. This video does a great job covering the details of the 407 ETR business, including some of the insane numbers like 300% price hikes post-acquisition and 80% EBITDA margins.

- Elliott Holland of Guardian Due Diligence put together a presentation titled Most QoEs Miss 50% of the Work. This is a mandatory (and entertaining) watch for all acquirers of small and medium-sized businesses.