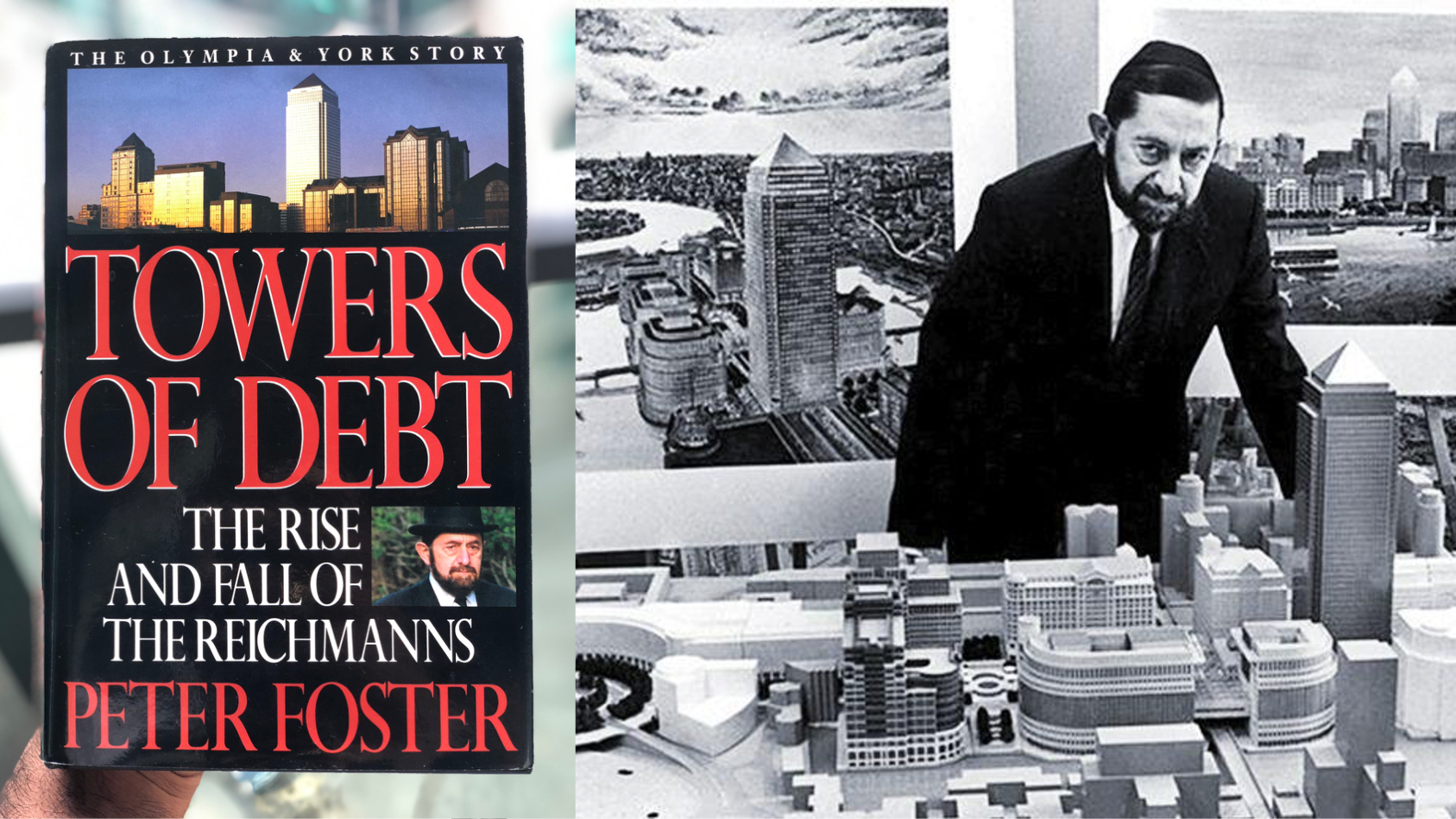

Towers of Debt is a detailed recount of the rise and collapse of The Reichmanns, a wealthy Canadian business family. Their company, Olympia and York, grew to become the largest real estate empire in the world before its tragic demise. They were responsible for building and managing financial centers in Toronto, New York City, and London.

Most people are familiar with how their real estate empire collapsed under a $20bn debt load, but this book revealed so much more and I’m going to share lessons that I learned. (But before I do I want to make it clear that I am not passing judgment on the Reichmann family, which is easy to do in hindsight when the outcomes are obvious).

1. Never Over-Leverage

The most obvious lesson from Towers of Debt is right in its title: never take on too much debt. At its peak, Olympia and York had $20bn of debt on its books, which far exceeded the value of their real estate holdings. But what I found interesting was that Olympia & York heavily relied on commercial paper to finance its real estate operations. Commercial paper is a short-term note issued by creditworthy corporations and the full amount is due usually within a few months of issuance.

Paul Reichmann was financing long-term real estate projects with short-term commercial paper. Real estate development, especially at Olympia & York’s scale, can take several years to complete and produces zero income in the interim.

Real estate is the perfect type of asset to utilize leverage on, but too much and the wrong type of debt can get you into trouble fast.

2. Do Your Due Diligence

The Reichmanns were very secretive, especially with lenders, their primary financing source. They had built up an incredible reputation and track record in real estate, that allowed them to obtain favourable loans without much due diligence.

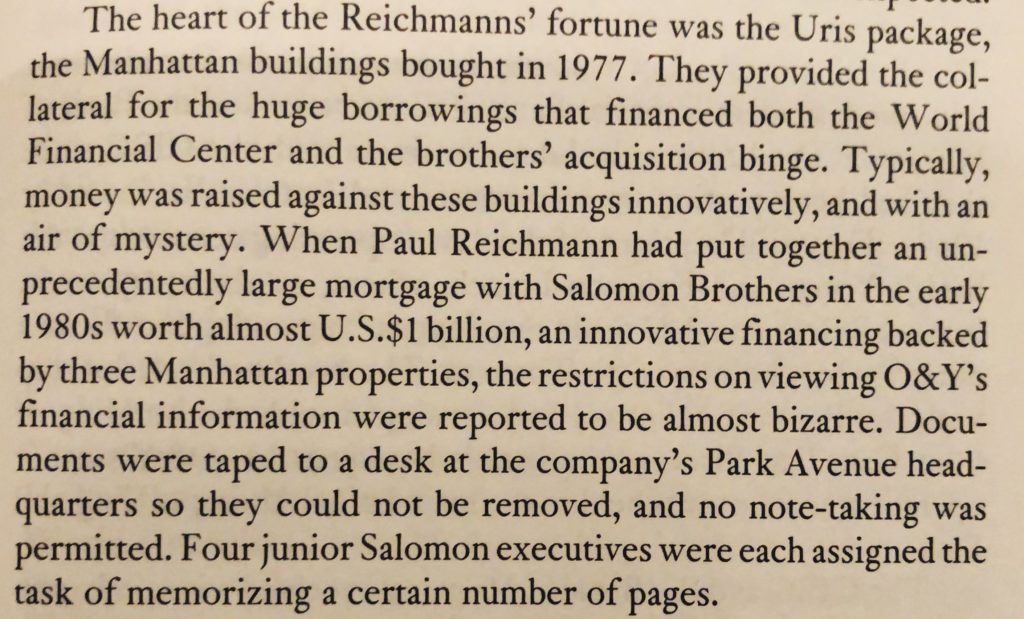

The family never shared their detailed financial information with any lender. As a result, no one outside the Reichmanns had any real idea what assets and liabilities they had. Just take a look at the ridiculous “due diligence” that the Reichmanns got away with when borrowing nearly $1bn:

Lenders only understood the whole picture when Olympia & York filed for bankruptcy protection, at which point it was too late. No matter how much of a star the entrepreneur is, when making an investment doing due diligence is a must, instead of relying on reputation alone.

3. Tight Control = Risk Concentration

Tight control of the family business worked well for the Koch brothers. Koch Industries didn’t utilize leverage and were involved in fairly low-risk businesses.

The Reichmanns, on the other hand, were in real estate development – widely considered high risk. Their excessive use of leverage only further heightened the risk. Sharing that risk among other partners or shareholders would have reduced the family’s direct exposure, but they chose to have full control instead.

Tight ownership was the key ingredient in building their wealth, but the concentration of risk eventually came back to bite them. In the end, their unwillingness to issue equity at favourable prices forced them to give up equity and assets at unfavourable prices.

4. Don’t Stretch Yourself Thin With Unfamiliar Industries

The Reichmann family’s foray into other corporate ventures is an aspect that is often overlooked in their saga. After a few of their mega-successes in real estate, they decided to diversify their wealth. Their first acquisition was a resource company called Gulf Canada for a staggering $3.8bn, the largest private transaction in Canadian history at the time (1986). Following this deal came their acquisition of the liquor business, Hiram Walker, for $2.2bn.

Both deals were financed primarily through debt, and the latter deal was met with significant headwinds. There was a messy court battle over the assets of Hiram Walker, that didn’t rule in the favour of the Reichmann’s. In fact, neither ventures proved profitable and the Reichmann’s ended up draining much-needed cash reserves.

These deals further leveraged the family portfolio and proved to be a distraction. The family did not have experience in either industry to make those ventures deliver a high return.

5. Past Performance is Not Indicative of Future Performance

Paul Reichmann had an incredible real estate success streak that started in the early 60s and carried through into the nineties. This includes massive office development projects in Toronto and New York City, which proved to be incredibly lucrative.

However, their hot streak came to an end with the Canary Wharf development in London. This was their largest and most ambitious project yet, with an estimated cost of around $3bn USD. Paul Reichmann was no stranger to making and winning bold bets, and it worked great for him…until it didn’t

The fact that I had never been wrong created character flaws that caused me to make mistakes.

Paul Reichmann, 1997

The Canary Wharf development proved disastrous with unoccupied buildings, cost overruns, significant delays and lack of cooperation from the British government. It was a huge gamble that made up a significant chunk of the Reichmann family net worth and it, unfortunately, did not pay off this time.

This was the nail on the coffin that pushed Olympia & York into bankruptcy.

6. Everything Can Go Wrong All At Once

The real estate slump of the early 90s ensured that the Canary Wharf under-performance was unforgivable. Values across their entire portfolio plummeting, coupled with a credit crunch, made it impossible for the Reichmanns to borrow any more money. To make matters worse, the family’s corporate portfolio (including the liquor and resource businesses) started tanking simultaneously.

Filing for bankruptcy was a dramatic turn of events considering that only a couple of years prior, Paul Reichmann was in Forbes Magazine with a quoted net worth of $12.8bn.

It was a perfect storm of misfortunes that led to ruin. It could easily have happened to anyone no matter their past successful track record. This is reason enough to never over-leverage (lesson #1), and keep cash reserves aside to survive adversities.

Final Thoughts

Towers of Debt was a great read, a cautionary tale chronicling an inspiring uprise and epic downfall. Learning from and applying these lessons is a must for anyone investing.

The book was published before the Reichmann saga truly finished. Paul Reichmann managed to rebuild the family wealth to $1bn+ before he passed away in 2013. He left his mark on the world with his audacious projects that shaped the financial centers of major cities.

Hi there! I’m Jay Vasantharajah, Toronto-based entrepreneur and investor.

This is my personal blog where I share my experiences building businesses, making investments, managing personal finances, and traveling the world.

Subscribe below, and expect to get a couple of emails a month with some free, valuable, and actionable content.

4 thoughts on “Lessons From Towers of Debt, The Reichmann Story”

Nice summary, thanks for the content Jay, I really appreciate it.